Excitement About Personal Loans Canada

Excitement About Personal Loans Canada

Blog Article

An Unbiased View of Personal Loans Canada

Table of ContentsAbout Personal Loans CanadaPersonal Loans Canada - Questions8 Easy Facts About Personal Loans Canada DescribedNot known Facts About Personal Loans CanadaPersonal Loans Canada - The Facts

This suggests you have actually offered every dollar a task to do. placing you back in the vehicle driver's seat of your financeswhere you belong. Doing a normal budget plan will certainly give you the self-confidence you require to manage your cash successfully. Good ideas involve those that wait.Yet conserving up for the large points implies you're not going into debt for them. And you aren't paying much more over time due to the fact that of all that passion. Count on us, you'll enjoy that family members cruise or playground collection for the youngsters way extra recognizing it's currently spent for (as opposed to paying on them until they're off to college).

Absolutely nothing beats comfort (without debt naturally)! Financial obligation is a trickster. It reels you in only to hold on for dear life like a crusty old barnacle. But you don't need to turn to personal car loans and debt when points get tight. There's a better way! You can be without financial obligation and begin making real grip with your money.

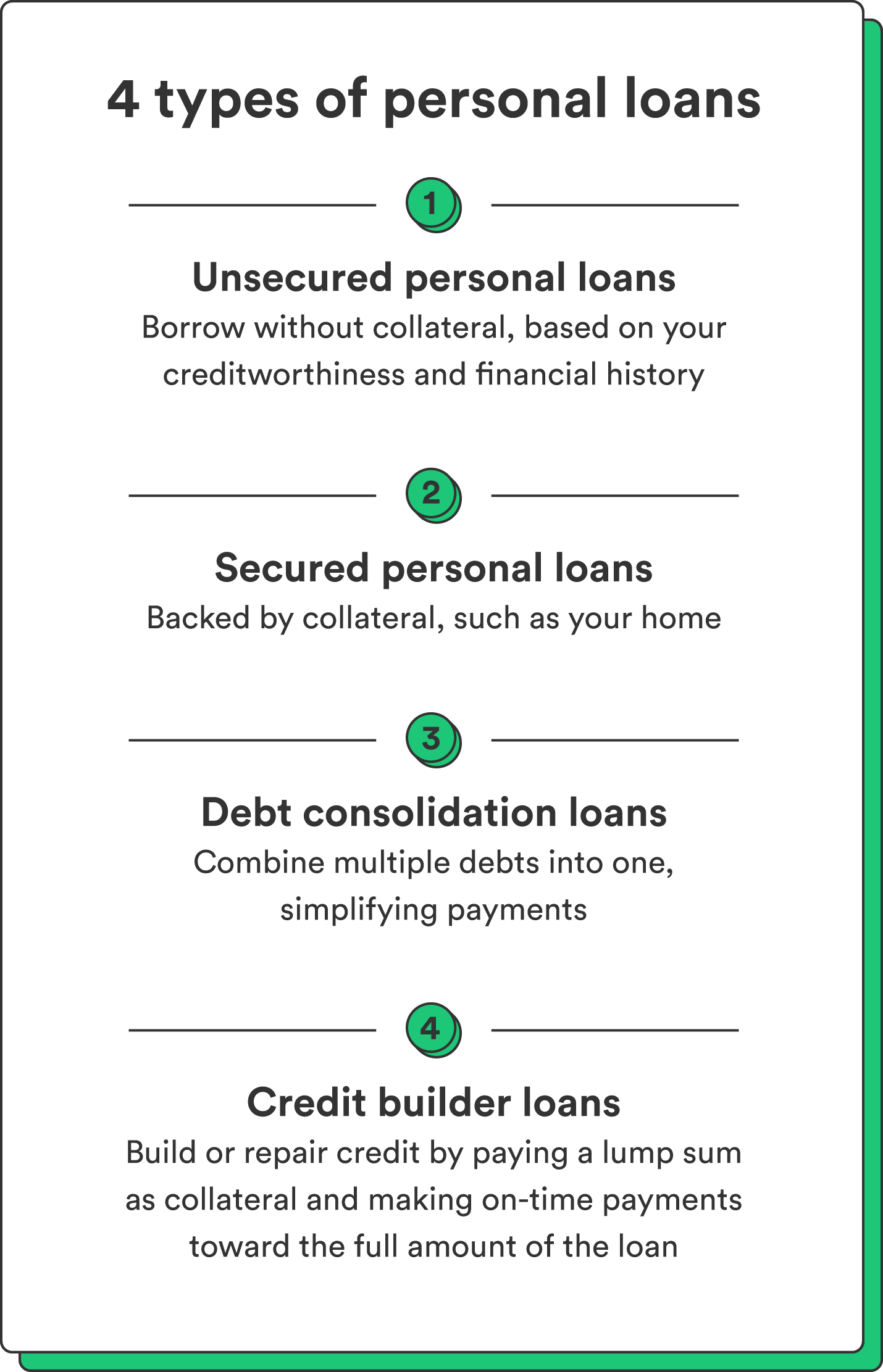

They can be secured (where you provide collateral) or unsecured. At Springtime Financial, you can be approved to obtain cash up to financing amounts of $35,000. A personal finance is not a credit line, as in, it is not rotating financing (Personal Loans Canada). When you're approved for a personal lending, your loan provider gives you the total at one time and then, generally, within a month, you begin settlement.

Things about Personal Loans Canada

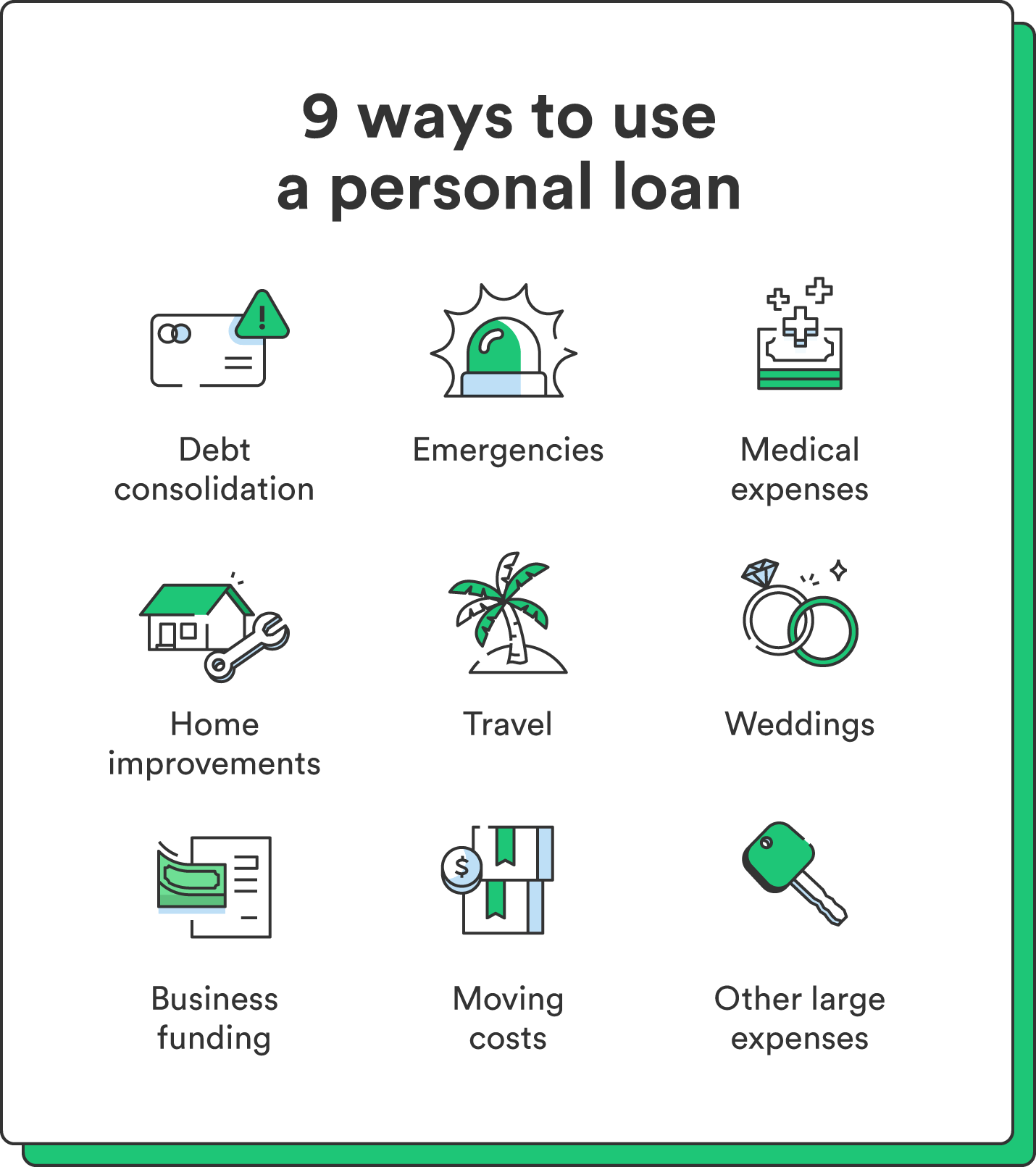

A typical factor is to combine and merge debt and pay every one of them off at the same time with a personal loan. Some banks placed terms on what you can make use of the funds for, yet many do not (they'll still ask on the application). home improvement financings and remodelling lendings, loans for relocating costs, vacation loans, wedding celebration fundings, clinical finances, auto repair work fundings, finances for rental fee, little vehicle finances, funeral loans, or various other bill settlements in general.

The need for personal loans is increasing amongst Canadians interested in running away the cycle of payday fundings, combining their financial obligation, and restoring their credit history score. If you're applying for a personal finance, right here are some points you need to keep in mind.

Personal Loans Canada - An Overview

Additionally, you could be able to minimize just how much total passion you pay, which indicates even more cash can be conserved. Personal loans are effective tools for developing your credit report. Repayment background represent 35% of your credit scores score, so the longer you make routine repayments in a timely manner the more you will certainly see your rating rise.

Individual car loans provide a wonderful opportunity for you to restore your credit and pay off financial debt, however if you don't budget plan correctly, you might dig yourself into an even deeper opening. Missing among your regular monthly settlements can have an adverse result on your debt score yet missing out on numerous can be devastating.

Be prepared to make every single settlement on schedule. It's true that an individual lending can be made use of for anything and it's less complicated to obtain accepted than it ever was in the past. But if you don't have an immediate need the added cash money, it may not be the most effective solution for you.

The dealt with regular monthly repayment amount on a personal loan depends upon just how much you're obtaining, the passion rate, and the set term. Personal Loans Canada. Your rate of interest will certainly depend on aspects like your credit rating and income. Many times, individual loan rates are a great deal lower than charge card, however sometimes they can be higher

See This Report about Personal Loans Canada

Perks consist of great passion rates, incredibly fast processing and financing times & the privacy you might want. Not everyone likes walking into a bank to ask for money, so if this is a difficult place for you, or you simply do not have time, looking at on the internet lending institutions like Springtime is a terrific choice.

Repayment sizes for personal finances normally drop within 9, 12, 24, 36, 48, or 60 months (Personal Loans Canada). Shorter payment times news have really high month-to-month settlements yet then it's over quickly and you don't shed more money to interest.

Little Known Facts About Personal Loans Canada.

You could obtain a lower rate of interest rate if you finance the financing over a much shorter period. An individual term funding comes with a concurred upon go right here repayment schedule and a taken care of or drifting interest rate.

Report this page