One Of The Most Typical Utilizes for Hard Money Loans In Georgia Among Real Estate Investors

One Of The Most Typical Utilizes for Hard Money Loans In Georgia Among Real Estate Investors

Blog Article

Just How a Hard Cash Funding Works: a Comprehensive Overview for Customers

Hard cash loans provide an unique financing alternative that leverages real estate as collateral, appealing especially to those who call for quick accessibility to capital. Recognizing the auto mechanics of these finances is important for customers, as the procedure varies considerably from typical lending methods.

Comprehending Tough Cash Finances

Recognizing difficult money lendings is essential for both actual estate investors and debtors seeking fast capital. Difficult cash loans are secured by real estate, with the residential or commercial property itself serving as security.

The terms of hard money lendings are usually short-term, varying from a couple of months to a couple of years, and they typically include greater rate of interest compared to conventional car loans. This premium reflects the greater risk loan providers think and the expedited nature of the funding procedure. Capitalists often make use of difficult cash fundings for fix-and-flip projects, allowing them to obtain, restore, and market buildings rapidly commercial.

Additionally, the underwriting standards for difficult cash fundings are typically less rigid, facilitating much faster authorizations. Nonetheless, debtors have to continue to be vigilant concerning the settlement terms and prospective fines for default, as these loans can lead to significant monetary consequences if not handled appropriately. Comprehending these characteristics is important for educated decision-making in realty funding.

The Application Refine

Looking for a difficult money financing entails a streamlined process that can be finished fairly quickly contrasted to traditional loaning approaches. The primary step is to determine a reputable hard money lending institution that focuses on the sort of residential property financing you call for. Consumers commonly begin by sending a car loan application, that includes essential information concerning the property, the desired usage of the funds, and their economic standing.

As soon as submitted, the lending institution will certainly perform a home assessment to determine its market worth and analyze the risk included. Unlike conventional car loans that heavily evaluate credit scores, tough cash lending institutions largely concentrate on the collateral worth. This suggests that residential or commercial properties with strong equity can safeguard funding even if the debtor's credit rating is less than stellar.

After the assessment, the lender will provide a lending proposition, describing the terms, rates of interest, and any type of additional costs. Upon acceptance, consumers will require to supply needed documentation, such as evidence of identification and possession of the property. The last action is the closing procedure, where the funds are paid out, enabling customers to use the resources for their designated function.

Benefits of Tough Money Financings

Furthermore, difficult money car loans are mainly based on the value of the collateral as opposed to the debtor's creditworthiness. This can be particularly helpful for those with less-than-perfect credit score or for investors looking to take advantage of homes with equity. The flexible underwriting requirements allow consumers to access funds that might or else be not available via standard borrowing channels.

Moreover, tough cash lending institutions frequently have a more streamlined approval procedure, which can be beneficial for genuine estate capitalists that need fast accessibility to capital for home procurements or restorations. This agility can result in an one-upmanship in fast-paced markets.

Last but not least, tough cash financings can internet supply a valuable device for debtors looking for to fund distinct projects that do not fit standard financing criteria, hence expanding their investment possibility.

Potential Threats and Downsides

While tough cash financings can be an attractive choice for some customers, they are not without their potential risks and drawbacks. Among the most substantial worries is the high rate of interest connected with these finances, which can typically go beyond those of conventional funding. Hard Money Loans In Georgia. This elevated price can lead to substantial economic browse this site stress, especially if the borrower encounters unanticipated obstacles in repaying the funding

Additionally, tough cash financings normally come with shorter payment terms, commonly ranging from one to 3 years. This limited timeframe can develop stress for borrowers to sell or refinance their residential property swiftly, which might not always straighten with market problems. In addition, the dependence on the residential or commercial property's worth rather than the consumer's creditworthiness implies that fluctuations in the property market can significantly impact the funding's viability.

An additional remarkable danger is the lack of governing oversight that governs hard cash financing. This can bring about aggressive borrowing methods or negative terms that are not clear to the consumer. In general, while difficult money loans can offer quick access to funds, it is necessary for borrowers to thoroughly analyze these threats and consider their long-term monetary effects before proceeding.

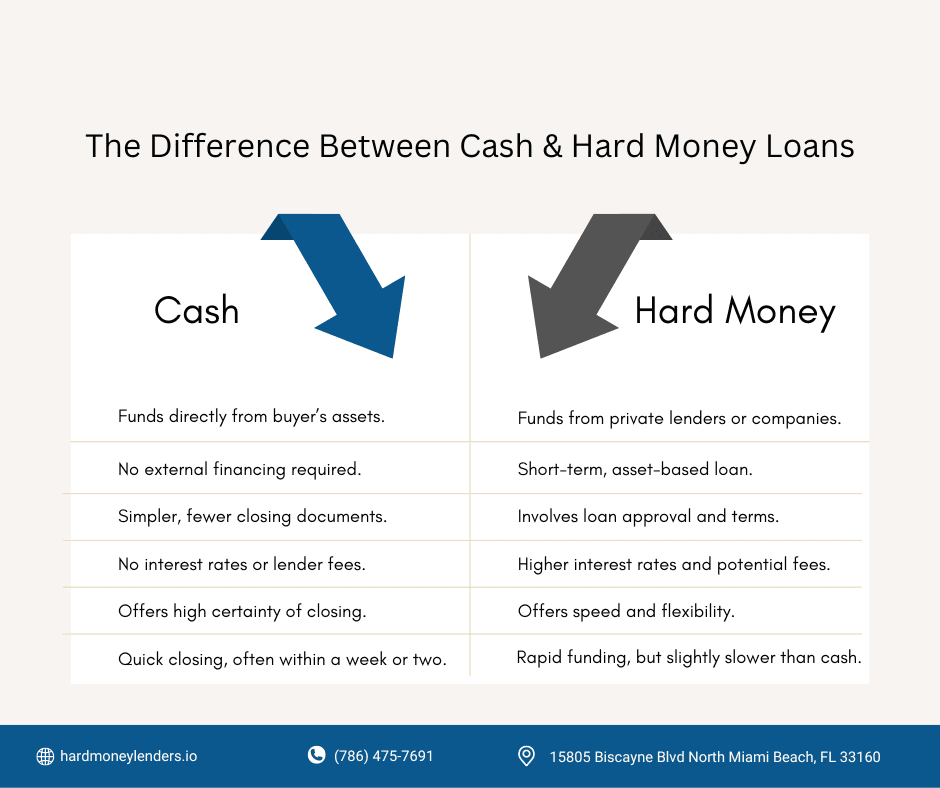

Contrasting Hard Cash to Typical Car Loans

When examining financing alternatives, it is critical to understand the vital differences in between tough cash lendings and conventional financings. Difficult cash loans are usually safeguarded by real estate and are moneyed by exclusive capitalists or firms. They typically prioritize the worth of the collateral instead than the borrower's creditworthiness. Standard financings, on the various other hand, are normally released by financial institutions or lending institution and depend greatly on the debtor's credit rating, revenue, and monetary background.

Rate of interest on tough money car loans are typically greater, reflecting the raised danger for loan providers - Hard Money Loans In Georgia. Nevertheless, they supply faster authorization procedures and much less stringent credentials criteria, making them appealing for those requiring instant funding, such as next investor. Conventional loans, while slower to refine, commonly featured lower passion prices and longer repayment terms, making them more ideal for debtors seeking secure, long-lasting funding

Ultimately, the option in between tough money and typical car loans relies on specific situations, including necessity, credit scores condition, and the specific economic goals of the consumer. Comprehending these distinctions can help direct customers in selecting one of the most suitable funding option for their demands.

Final Thought

In recap, hard cash fundings provide a viable funding alternative for consumers calling for quick access to funds, particularly when conventional financing methods are inaccessible. Inevitably, cautious examination of this financing method in contrast to traditional car loans is important for notified decision-making.

Understanding tough money finances is essential for both genuine estate investors and customers looking for fast capital.The terms of hard money car loans are usually temporary, ranging from a couple of months to a few years, and they typically come with greater interest prices compared to traditional car loans. Unlike traditional loans that might take months or weeks to procedure, tough money car loans can frequently be secured in a matter of days, permitting borrowers to exploit on time-sensitive investment possibilities.

When reviewing financing alternatives, it is crucial to understand the essential distinctions between difficult money car loans and typical finances.In recap, tough cash fundings offer a practical funding choice for customers calling for fast access to funds, especially when traditional financing avenues are inaccessible.

Report this page